CRM investor relations is a specialized field that leverages customer relationship management (CRM) tools and strategies to enhance communication and engagement with investors. It involves utilizing CRM systems to manage investor data, track interactions, and automate communication, fostering stronger relationships and streamlining investor outreach efforts.

Importance and Benefits:

- Improved Investor Communication: CRM systems enable efficient and personalized communication with investors, ensuring timely and relevant information delivery.

- Enhanced Investor Engagement: By tracking interactions and preferences, organizations can tailor their outreach strategies, increasing investor engagement and satisfaction.

- Streamlined Investor Outreach: Automation capabilities within CRM systems streamline investor outreach tasks, freeing up time for more strategic initiatives.

- Improved Investor Data Management: CRM systems provide a centralized platform for managing investor data, ensuring accuracy and accessibility.

- Increased Investor Visibility: CRM systems offer a comprehensive view of investor interactions, providing valuable insights into investor behavior and preferences.

Transition to Main Article Topics:

In the following sections, we will delve deeper into the key aspects of CRM investor relations, exploring its historical context, best practices, and the latest trends shaping this evolving field.

CRM Investor Relations

CRM investor relations plays a vital role in enhancing communication, engagement, and data management for organizations. Here are seven key aspects that delve into its various dimensions:

- Centralized Data: Managing investor data in a single, accessible platform.

- Personalized Communication: Tailoring communication to individual investor preferences.

- Automated Outreach: Streamlining investor outreach tasks through automation.

- Improved Engagement: Tracking interactions to increase investor involvement.

- Enhanced Reporting: Generating comprehensive reports on investor activity.

- Increased Visibility: Gaining a complete view of investor interactions and preferences.

- Relationship Building: Fostering stronger relationships with investors.

These aspects are interconnected and contribute to the overall effectiveness of CRM investor relations. For instance, centralized data enables personalized communication, leading to improved engagement. Enhanced reporting provides insights that inform strategic decision-making, while increased visibility allows organizations to tailor their outreach efforts more effectively. Ultimately, CRM investor relations helps organizations build stronger relationships with their investors, improving communication, increasing engagement, and driving long-term success.

Centralized Data

Centralized data is a cornerstone of effective CRM investor relations. By consolidating investor data into a single, accessible platform, organizations gain a comprehensive view of their investor base, enabling them to make informed decisions and tailor their outreach strategies more effectively.

Real-time access to accurate and up-to-date investor data is crucial for building strong relationships. A centralized CRM system allows organizations to track key investor information, such as contact details, investment history, and communication preferences. This data can then be used to personalize communication, segment investors based on specific criteria, and target outreach efforts accordingly.

Moreover, centralized data enhances collaboration and efficiency within organizations. When all investor data is stored in a single location, different teams, such as investor relations, sales, and marketing, can easily access and share information, ensuring a cohesive and consistent investor experience.

In summary, centralized data is essential for effective CRM investor relations, enabling organizations to manage investor data efficiently, personalize communication, and make data-driven decisions that drive long-term success.

Personalized Communication

Personalized communication is a critical component of CRM investor relations, enabling organizations to build stronger relationships with their investors by understanding and addressing their unique needs and preferences. CRM systems provide the tools and capabilities to capture, store, and analyze investor data, allowing organizations to tailor their communication strategies accordingly.

Effective personalized communication involves segmenting investors based on factors such as investment goals, risk tolerance, and communication preferences. By leveraging CRM data, organizations can create targeted communication campaigns that resonate with each investor segment. For example, an organization may send regular updates on market trends to investors with a high-risk tolerance, while providing more conservative investors with information on low-risk investment opportunities.

Personalized communication not only enhances the investor experience but also leads to improved engagement and satisfaction. When investors feel that their individual needs are being met, they are more likely to engage with the organization, attend events, and participate in investment opportunities. This increased engagement can lead to stronger relationships, increased investment, and improved overall investor loyalty.

In summary, personalized communication is essential for effective CRM investor relations. By tailoring communication to individual investor preferences, organizations can build stronger relationships, improve engagement, and drive long-term success.

Automated Outreach

In the context of CRM investor relations, automated outreach plays a vital role in streamlining communication and engagement with investors. CRM systems offer a range of automation capabilities that can be leveraged to save time, improve efficiency, and enhance the overall investor experience.

- Automated Communication: CRM systems can automate email campaigns, newsletters, and other communications, ensuring that investors receive timely and relevant information without manual intervention.

- Event Management: CRM systems can automate event invitations, registration, and follow-up, streamlining the process and freeing up time for more strategic tasks.

- Lead Nurturing: CRM systems can automate lead nurturing campaigns, providing personalized content and engagement based on investor preferences and behavior.

- Investor Segmentation: CRM systems can automate investor segmentation based on criteria such as investment goals, risk tolerance, and communication preferences, enabling targeted outreach and personalized communication.

By automating these tasks, organizations can streamline their investor outreach efforts, improve communication efficiency, and allocate resources more effectively. Automated outreach also ensures that investors receive consistent and timely information, enhancing their overall experience and fostering stronger relationships.

Improved Engagement

In the realm of CRM investor relations, improved engagement is paramount to fostering strong relationships with investors and driving long-term success. By tracking interactions through CRM systems, organizations gain valuable insights into investor behavior, preferences, and areas for improvement, enabling them to tailor their engagement strategies accordingly.

- Personalized Content and Communication: Tracking interactions reveals investor interests and preferences, allowing organizations to deliver personalized content and communication that resonates with each investor. This tailored approach enhances engagement and strengthens relationships.

- Targeted Outreach: By understanding investor engagement patterns, organizations can identify the most effective channels and times to reach out. Targeted outreach increases the likelihood of capturing investor attention and driving desired actions.

- Event Engagement: Tracking interactions at events provides insights into investor interests and engagement levels. This information can be used to improve future events, ensuring that they are tailored to meet investor needs and maximize engagement.

- Lead Nurturing: CRM systems can track investor interactions across multiple touchpoints, enabling organizations to nurture relationships and guide investors through the investment journey. Targeted lead nurturing campaigns can increase investor engagement and conversion rates.

In summary, tracking interactions through CRM investor relations empowers organizations to develop data-driven engagement strategies that resonate with investors, build stronger relationships, and drive long-term success.

Enhanced Reporting

Enhanced reporting is a crucial component of CRM investor relations as it provides organizations with valuable insights into investor activity, enabling them to make informed decisions, measure the effectiveness of their outreach efforts, and improve their strategies over time.

CRM systems offer robust reporting capabilities that allow organizations to generate comprehensive reports on a wide range of investor-related metrics. These reports can include data on investor demographics, communication history, event attendance, investment activity, and more. By analyzing these reports, organizations can gain a deeper understanding of their investor base, their investment preferences, and their engagement levels.

This information can be used to tailor outreach efforts, target marketing campaigns, and develop personalized communication strategies that resonate with each investor. For example, an organization may use reporting data to identify investors who have not engaged with the company in a while and reach out to them with personalized content or invitations to upcoming events.

Enhanced reporting also plays a vital role in measuring the effectiveness of CRM investor relations initiatives. By tracking key metrics such as investor engagement rates, conversion rates, and overall investment growth, organizations can assess the impact of their outreach efforts and make adjustments as needed.

In summary, enhanced reporting is an essential aspect of CRM investor relations as it provides organizations with the insights they need to make informed decisions, measure the effectiveness of their outreach efforts, and improve their strategies over time.

Increased Visibility

Increased visibility is a crucial component of CRM investor relations as it provides organizations with a comprehensive view of investor interactions and preferences. This enhanced visibility enables organizations to tailor their outreach efforts, target marketing campaigns, and develop personalized communication strategies that resonate with each investor.

CRM systems offer a centralized platform that consolidates investor data from multiple sources, including emails, phone calls, social media interactions, and event attendance. This comprehensive data repository provides organizations with a complete picture of investor behavior, preferences, and areas for improvement. By analyzing this data, organizations can gain valuable insights into their investor base, their investment preferences, and their engagement levels.

For example, an organization may use increased visibility to identify investors who have shown interest in a particular investment product or asset class. This information can then be used to target these investors with personalized communication and marketing campaigns that provide additional information and insights on the relevant investment opportunities. Additionally, increased visibility can help organizations identify potential investors who may be a good fit for their offerings based on their investment history, risk tolerance, and other factors.

In summary, increased visibility through CRM investor relations empowers organizations to develop data-driven engagement strategies that resonate with investors, build stronger relationships, and drive long-term success.

Relationship Building

Relationship building is a fundamental aspect of CRM investor relations, as it enables organizations to foster stronger, long-lasting connections with their investors. CRM systems provide the tools and capabilities to manage and nurture investor relationships, facilitating personalized communication, targeted engagement, and tailored outreach efforts.

By leveraging CRM data and insights, organizations can gain a deep understanding of their investors’ individual needs, preferences, and investment goals. This understanding allows them to tailor their communication and engagement strategies accordingly, creating personalized experiences that resonate with each investor. Regular communication, timely updates, and proactive outreach help build trust and strengthen relationships over time.

For example, a wealth management firm can use its CRM system to track investor preferences and risk tolerance. This information can then be used to provide investors with tailored investment recommendations and portfolio management advice that aligns with their specific financial goals. By fostering stronger relationships with their investors, organizations can increase investor satisfaction, loyalty, and long-term investment commitment.

In summary, relationship building is a critical component of CRM investor relations, enabling organizations to develop personalized engagement strategies, strengthen investor connections, and drive long-term success.

FAQs on CRM Investor Relations

Introduction

Customer relationship management (CRM) investor relations is a specialized field that leverages CRM tools and strategies to enhance communication and engagement with investors. Here are answers to some frequently asked questions about CRM investor relations:

Question 1: What is the purpose of CRM investor relations?

CRM investor relations aims to improve communication, engagement, and data management for organizations. It involves using CRM systems to manage investor data, track interactions, and automate communication, fostering stronger relationships and streamlining investor outreach efforts.

Question 2: What are the benefits of CRM investor relations?

CRM investor relations offers several benefits, including improved investor communication, enhanced investor engagement, streamlined investor outreach, improved investor data management, increased investor visibility, and stronger investor relationships.

Question 3: What are the key aspects of CRM investor relations?

Key aspects of CRM investor relations include centralized data, personalized communication, automated outreach, improved engagement, enhanced reporting, increased visibility, and relationship building.

Question 4: How can organizations implement CRM investor relations?

To implement CRM investor relations, organizations should consider investing in a CRM system, establishing a dedicated investor relations team, and developing a comprehensive CRM investor relations strategy.

Question 5: How can CRM investor relations contribute to long-term success?

CRM investor relations can contribute to long-term success by fostering stronger investor relationships, improving investor engagement, and providing valuable insights into investor behavior and preferences. This can lead to increased investment, improved investor loyalty, and enhanced reputation.

Question 6: What are the best practices for CRM investor relations?

Best practices for CRM investor relations include leveraging data-driven insights, personalizing communication, automating tasks, measuring and analyzing results, and continually improving strategies.

Summary

CRM investor relations is a valuable tool for organizations to enhance their relationships with investors. By leveraging CRM systems and strategies, organizations can improve communication, increase engagement, and gain valuable insights into investor behavior, ultimately contributing to long-term success.

Transition to the Next Section

To learn more about CRM investor relations and its benefits, explore the following resources:

- CRM Investor Relations: A Comprehensive Guide

- Best Practices for CRM Investor Relations

- Case Studies in Successful CRM Investor Relations

CRM Investor Relations Tips

CRM investor relations is a specialized field that leverages CRM tools and strategies to enhance communication and engagement with investors. Here are several tips to help organizations effectively implement CRM investor relations:

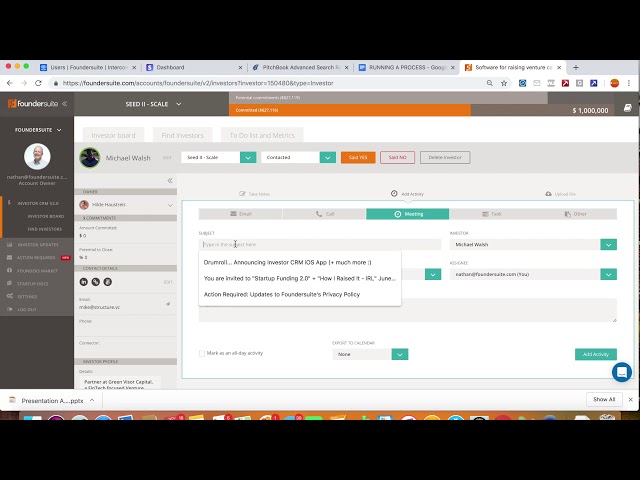

Tip 1: Centralize Investor Data

Consolidate investor data into a single, accessible CRM system to gain a comprehensive view of your investor base. This enables personalized communication and targeted outreach strategies.

Tip 2: Personalize Communication

Leverage CRM data to tailor communication to individual investor preferences. Segment investors based on investment goals, risk tolerance, and communication channels to deliver relevant and engaging content.

Tip 3: Automate Outreach

Utilize CRM automation capabilities to streamline investor outreach tasks such as email campaigns, event invitations, and lead nurturing. This saves time and improves efficiency.

Tip 4: Track Interactions

Monitor investor interactions across multiple touchpoints to understand their interests and engagement levels. This data can be used to personalize communication, identify opportunities, and improve the overall investor experience.

Tip 5: Generate Comprehensive Reports

Use CRM systems to generate reports on investor activity, engagement, and investment trends. Analyze these reports to measure the effectiveness of outreach efforts and make data-driven decisions.

Tip 6: Leverage Data-Driven Insights

Extract insights from CRM data to understand investor behavior, preferences, and areas for improvement. Use this knowledge to tailor outreach strategies, develop personalized content, and enhance the overall investor experience.

Summary

By following these tips, organizations can effectively implement CRM investor relations to improve communication, increase engagement, and gain valuable insights into investor behavior. This ultimately contributes to stronger investor relationships and long-term success.

Conclusion

In conclusion, CRM investor relations has emerged as a transformative approach to managing and nurturing investor relationships. By leveraging CRM tools and strategies, organizations can centralize investor data, personalize communication, automate outreach, track interactions, generate comprehensive reports, and leverage data-driven insights.

This comprehensive approach empowers organizations to build stronger relationships with their investors, fostering trust, engagement, and long-term commitment. As the investment landscape continues to evolve, CRM investor relations will play an increasingly vital role in driving success for organizations, enabling them to attract and retain valuable investors.

Youtube Video: